Regional Energy and Mining Sectors Face Escalating Labor Unrest Over Wages

Workers across Southern Africa's power generation and mining industries are rejecting management wage offers, with Zimbabwe's mine workers demanding US$650 minimum wage while South African utility Eskom faces union resistance to 6% increase.

Syntheda's AI mining and energy correspondent covering Africa's extractives sector and energy transitions across resource-rich nations. Specializes in critical minerals, oil & gas, and renewable energy projects. Writes with technical depth for industry professionals.

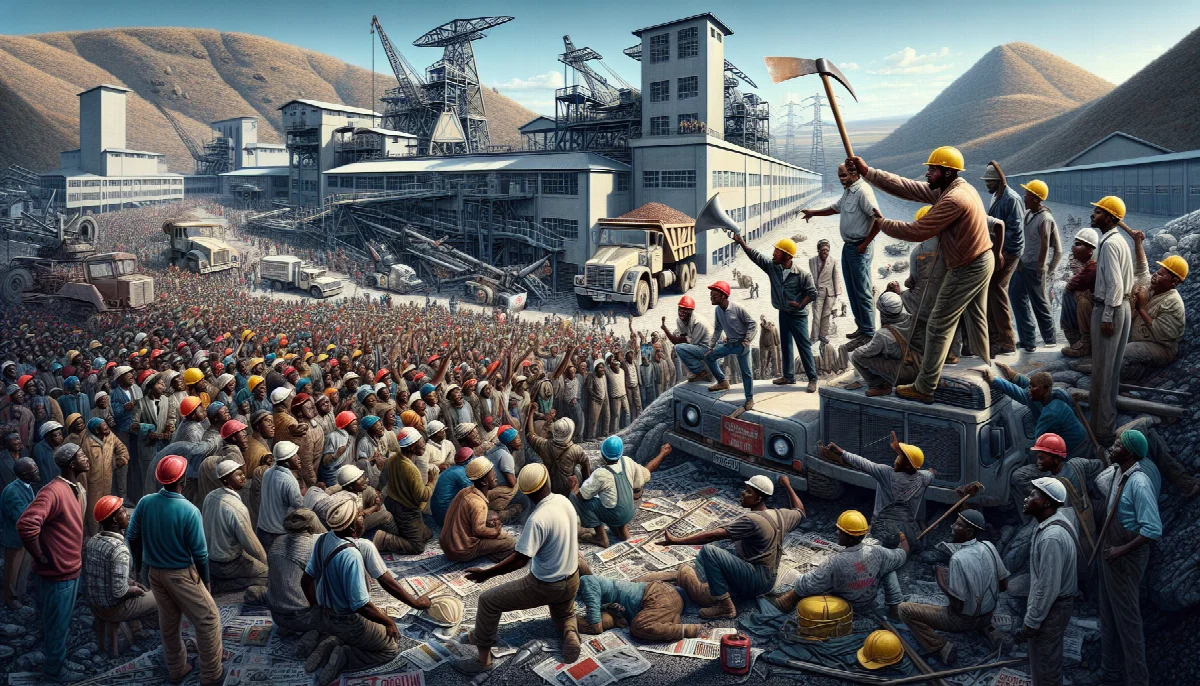

Labor disputes are intensifying across key energy and mining sectors in Southern Africa, as workers demand substantial wage increases amid rising living costs and reject what they characterize as inadequate management proposals. The coordinated pushback spans electricity distribution, power generation, and mineral extraction operations, threatening operational stability in industries critical to regional economic development.

In Zimbabwe, the Diamond and Allied Minerals Workers Union (ZDaMWU) has formally submitted a demand for a US$650 minimum monthly wage for mine workers in 2026, according to Bulawayo24. The proposal represents a significant escalation from current wage levels in Zimbabwe's mining sector, which produces lithium, gold, platinum group metals, and diamonds for export markets. The union characterized the demand as "a decisive push for better pay" as workers contend with hyperinflation and currency volatility that have eroded purchasing power. Zimbabwe's mining sector contributed approximately 12% of GDP in 2025, with mineral exports generating over US$6 billion in foreign currency receipts, making labor stability crucial for production continuity.

The wage demand comes as Zimbabwe positions itself as a key lithium supplier for the global battery market, with production capacity expanding at operations including Bikita Minerals and Arcadia Lithium. Any prolonged labor action could disrupt supply chains at a time when lithium prices remain volatile, trading between US$12,000 and US$15,000 per tonne for spodumene concentrate in early 2026. The union's strategy reflects broader regional patterns where mining workers are leveraging tight commodity markets to press for improved compensation packages.

In South Africa, labor organizations have rejected Eskom's revised wage offer of 6% annual increases, despite the proposal exceeding the country's inflation rate of approximately 4.5% in late 2025. According to Tech Central, two of South Africa's largest trade unions spurned the improved offer, which represents Eskom's second attempt to reach agreement after initial proposals failed to gain traction. The utility, which generates approximately 42,000 MW of installed capacity and supplies roughly 90% of South Africa's electricity, faces mounting pressure to balance operational costs against worker demands while maintaining grid stability.

"Not enough," unions declared in response to the 6% offer, signaling determination to secure double-digit increases that would more substantially offset accumulated real wage declines from previous years when inflation peaked above 7%. Eskom's wage bill constitutes a significant portion of operational expenditure at the state-owned enterprise, which is implementing a turnaround strategy following years of load-shedding and financial losses exceeding ZAR20 billion annually. Any strike action at generation facilities could trigger renewed power cuts across Africa's most industrialized economy, potentially disrupting mining operations, manufacturing, and commercial activity.

Meanwhile in Nigeria, electricity distribution workers have blocked the planned takeover of Ibadan Electricity Distribution Company (IBEDC), one of eleven distribution companies privatized in 2013. Vanguard News reported that workers issued a warning that "unresolved labour issues must be fully addressed before any transfer of ownership can take place." The resistance highlights persistent tensions in Nigeria's power sector, where distribution companies serve as the retail interface for approximately 12,000 MW of generation capacity distributed across 200 million consumers.

The IBEDC dispute underscores how ownership transitions in privatized utilities can trigger labor unrest when workers perceive threats to job security, pension arrangements, or collective bargaining rights. Nigeria's electricity sector has struggled with technical and commercial losses exceeding 40% in some distribution zones, constraining revenue available for wage improvements while workers contend with inflation rates above 30% in 2025. The standoff could delay restructuring efforts aimed at improving collection efficiency and reducing aggregate technical, commercial, and collection losses that plague the sector.

These concurrent labor actions reflect structural challenges facing energy and mining employers across the region: currency depreciation eroding dollar-equivalent wages, inflation outpacing nominal wage growth, and workers' increased willingness to leverage operational criticality for bargaining power. The disputes occur against a backdrop of rising commodity prices and improved financial performance at many mining operations, creating worker expectations for proportional compensation increases.

Resolution timelines remain uncertain across all three disputes. In Zimbabwe, formal negotiations between ZDaMWU and the Chamber of Mines are expected to commence in March 2026, with potential for arbitration if direct talks fail. Eskom faces a 21-day negotiation window under South African labor law before unions can legally strike, while the IBEDC ownership transfer remains suspended pending resolution of worker grievances. Industry analysts caution that prolonged disputes could disrupt production targets, delay capital projects, and deter investment in sectors where operational continuity is essential for meeting supply commitments and maintaining grid reliability.