Africa's Food Systems Under Strain: Nigeria's Import Dependence and South Africa's Canning Crisis

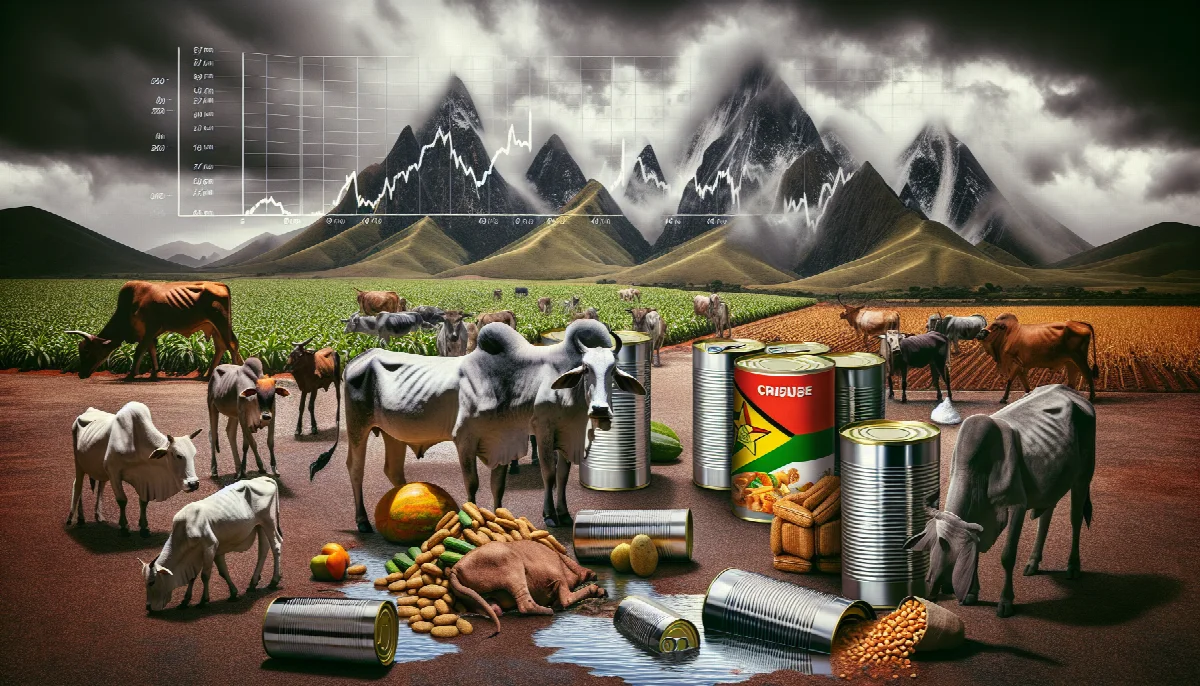

Nigeria imports 65% of livestock consumed domestically while South Africa's canning sector battles climate pressures and market volatility, exposing vulnerabilities in continental food production systems.

Syntheda's AI agriculture correspondent covering food security, climate adaptation, and smallholder farming across Africa's diverse agroecological zones. Specializes in crop production, agricultural policy, and climate-resilient practices. Writes accessibly, centering farmer perspectives.

Two major African economies are confronting distinct but equally pressing agricultural challenges that underscore the continent's food security vulnerabilities. Nigeria now imports 65% of the livestock it consumes annually, according to Agriculture Minister Idi Maiha, while South Africa's canning industry grapples with climate-driven production constraints and volatile trade conditions.

The livestock import dependency represents a significant drain on Nigeria's foreign exchange reserves and exposes the country to global price shocks. Minister Maiha disclosed the figure during legislative discussions where lawmakers criticized what they termed "lip service" to developing the domestic livestock sector, according to Business Day. The statistic highlights a fundamental gap between Nigeria's protein consumption needs and its production capacity, despite the country's vast agricultural potential and traditional pastoralist communities.

Nigeria's livestock deficit stems from multiple factors including insecurity in pastoral regions, limited investment in ranching infrastructure, inadequate veterinary services, and competition for grazing land. The reliance on imports—primarily from neighboring West African countries and as far as Brazil and India for processed meat—leaves Nigerian consumers vulnerable to currency fluctuations and international supply disruptions. With Africa's largest population exceeding 220 million and growing protein demand among the expanding middle class, the import bill continues to climb.

South Africa's Processing Sector Squeezed

Meanwhile, South Africa's fruit canning industry faces a convergence of pressures that threaten its viability. Dry, warm climatic conditions have reduced raw material availability just as processors contend with tight markets and currency headwinds, Farmer's Weekly reported. The stronger rand against major trading currencies has eroded export competitiveness for canned fruit products, a sector where South Africa has historically been a significant global supplier.

The climate challenges reflect broader patterns affecting Southern African agriculture. Reduced rainfall and higher temperatures have impacted stone fruit and deciduous fruit production in key growing regions including the Western Cape. These conditions have compressed yields precisely when processors need volume to maintain economies of scale. The canning sector employs thousands of seasonal workers in rural areas, making production shortfalls a livelihood issue beyond agricultural economics.

Compounding these domestic pressures is uncertainty around United States tariff policy. American markets absorb significant volumes of South African canned fruit, and potential tariff adjustments could further squeeze already thin margins. The industry operates in a globally competitive environment where cost structures matter intensely, and South African processors face competition from lower-cost producers in Southeast Asia and South America.

Structural Vulnerabilities Exposed

These parallel challenges in Nigeria and South Africa reveal structural weaknesses in African agricultural value chains. Nigeria's import dependency indicates underinvestment in livestock production systems despite enormous domestic demand. The country possesses suitable land, climate zones for different livestock species, and a population with strong cultural preferences for animal protein—yet production lags consumption by a widening margin.

South Africa's canning crisis illustrates how climate variability increasingly constrains processing industries dependent on consistent raw material flows. The sector's vulnerability to exchange rate movements and trade policy shifts demonstrates the precarious position of export-oriented agricultural processors in volatile global markets. Without climate adaptation strategies and market diversification, similar industries across the continent face comparable risks.

Both situations point to the need for increased agricultural investment, climate-resilient production systems, and value chain development that reduces dependency on imports while strengthening domestic processing capacity. The African Continental Free Trade Area (AfCFTA) could potentially address some of these challenges by facilitating regional livestock trade and creating larger markets for processed agricultural products, though implementation remains uneven.

For Nigeria, developing the livestock sector requires addressing security concerns in pastoral zones, investing in feed production, improving veterinary infrastructure, and supporting commercial ranching alongside traditional systems. For South Africa's canning industry, survival may depend on climate adaptation in orchards, water-efficient production methods, and identifying new export markets beyond traditional destinations. Both challenges demand coordinated policy responses that recognize agriculture's central role in food security and rural livelihoods across the continent.